The Global Tapestry of Digital Banking

In the dynamic landscape of financial services, the term “Digital Banking” has surfaced like a buzzword, yet its intricacies remain largely unexplored in Bangladesh. It has only been a few years since we as a nation have begun to warm up to mobile financial services, and on the horizon, a new concept has emerged, introducing us to the era of the ‘digital bank’.

But where did this come from? And what exactly does it have to offer?

Briefly said digital banks offer a comprehensive suite of financial services extending beyond simple transactions. This includes opening accounts, doing savings and investments, and getting loans—all managed digitally.

The concept of digital banking started gaining popularity following the rise of the Internet in the 1990s. Since then, many developed nations and emerging economies have embraced digital banking in their regions. And even though we are a bit late to the party, Bangladesh has exciting plans for the future of banking. So far, 52 organizations have already applied for digital bank licenses. This interest extends beyond conventional banks, encompassing insurance companies, mobile financial service providers, telecommunications companies, fintech firms, and even pharmaceutical companies—all competing for the coveted digital bank licenses.

With all this craze, let’s look at a few trends in digital banking already in developed nations and find out what we can soon expect to see in the banking landscape of Bangladesh.

1. Virtual Cards

Digital banks typically issue a variety of advanced technology-based products, including virtual cards and QR codes, to facilitate customer transactions. Virtual debit cards, akin to their physical counterparts, are complete with a card number linked to your account, an expiry date, and a three-digit CVV number. You can use your virtual debit card the same as your physical one, the only difference is that instead of swiping or inserting it at point-of-sales machines, you’ll have to tap your devices or make online payments. Notably, most of these virtual cards also provide multicurrency payment support.

In Bangladesh, MTBL introduced virtual cards in August 2023, while City Bank followed suit in November of the same year. However, in our country, the full spectrum of benefits, including multicurrency support, is yet to be fully realized.

2. Savings Pods

A Savings Pod functions as an account designed for setting and achieving specific savings goals. Users can create multiple savings pods, each labeled differently, allowing them to allocate money for different objectives, like buying a car or saving for a vacation. Moreover, transferring funds from a checking account to a savings pod is also a seamless process. Many digital banks have this feature including Current and Wio, where it’s called a “saving space”.

In Bangladesh, while banks like Bank Alfalah and City Alo offer goal-based savings, the online accessibility and flexibility of these services remain limited.

3. Budgeting Tools

Digital banks provide a diverse array of budgeting tools, ranging from basic features like expense tracking to more advanced options such as personalized budget creation, spending charts, and alerts for upcoming bills. Additionally, certain banks offer insights from these budgeting tools that amalgamate data from various linked accounts, including checking accounts, savings, cards, loans, and mortgages. These integrated tools enhance users’ ability to manage and monitor their finances effectively, contributing to a more informed and empowered financial journey.

Noteworthy digital banks such as SoFi, Capital One, and Huntington National Bank are at the forefront of delivering these services. However, we have yet to see such tools in the banking landscape of Bangladesh.

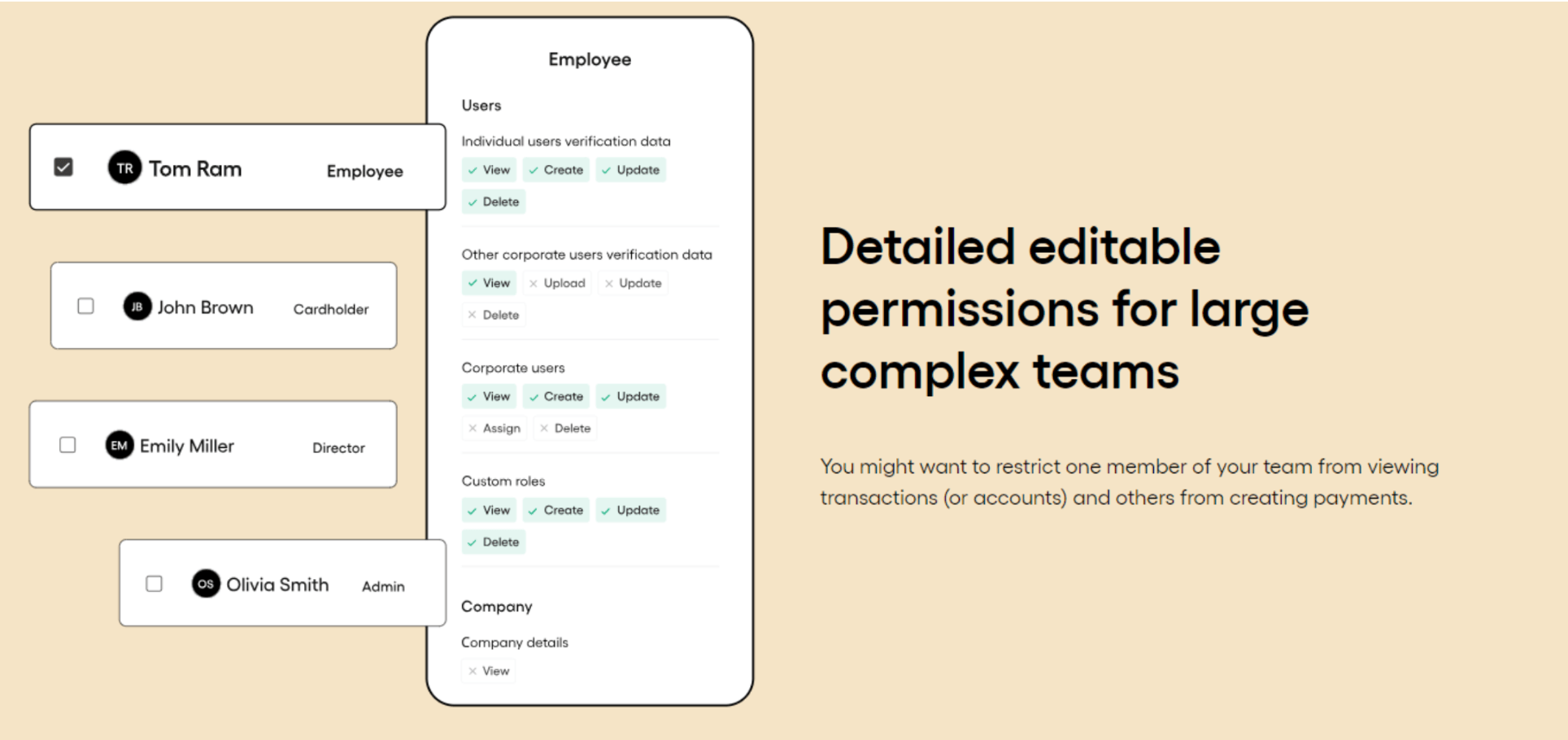

4. Team Access for Businesses

Many digital banks have this feature that allows designated members to access and oversee a business’s finances under controlled conditions. This works through the owner creating custom roles for team members, granting them the ability to predefine permission settings according to their preferences and apply them to others. These features empower finance teams to streamline internal processes such as invoice payments, expense reimbursement, and onboarding; providing businesses with an efficient and collaborative financial management solution that enhances productivity and reduces costs.

5. AI Chatbots and Virtual Assistants

Beyond offering budgeting tools, several banks like HSBC, Capital One, and Ally Bank have integrated virtual chatbots into their platform. These intelligent systems provide users with instant summaries of their spending behaviors, assist in setting personalized savings goals, remind users of bills, schedule payments, and even offer consultations on financial planning. These tools create a personalized banking experience that significantly saves time and enhances user satisfaction. Major banks like Citi also leverage AI to ensure compliance with trade regulations.

These represent just a few of the significant strides that digital banks are currently making. As Bangladesh joins the bandwagon, what plans are in store for us?

The Central Bank of Bangladesh has provided a set of guidelines that emphasize using technology for convenience, security, innovation, and accessibility while protecting customer interests and partnering strategically. Some noteworthy points in their provisions include leveraging technology like AI, biometrics, blockchain, etc. to provide innovative and efficient services. And also 24/7 availability of services through mobile and internet platforms, which reflect their commitment to creating a modern and secure financial ecosystem in Bangladesh.

Apart from that, the major banks in Bangladesh also have unique plans for digitalizing banking. Eastern Bank Ltd has recently shared its vision for a digital bank, placing a premium on developing an innovative and user-friendly mobile banking app. This app aims to incorporate budgeting tools, expense tracking, and features that provide personalized financial insights. Notably, the bank also emphasizes the integration of AI-driven chatbots for customer support, personalized product recommendations, and other functionalities. The incorporation of IoT (Internet of Things) and next-gen innovations further underscores their commitment to staying at the forefront of digital banking.

Keeping aside the ambitious goals, we must also acknowledge the huge challenge that Bangladesh faces in its pursuit of creating digital banks. In this regard, Mashrur Arefin, MD and CEO of City Bank, and vice-chairman of the Association of Bankers, Bangladesh (ABB) told the media that “A conventional bank with its conventional mindset, its physical presence related to cost structure, its culture of necessary bureaucracy, its knack for financing large-size projects, etc — can never turn into a digital bank.”

While opinions may differ on this matter, the popularity of digital banks and the relentless technological advancements in this sector continue to rise. To keep up with the offerings of the developed nations, Bangladesh will surely have to invest considerable effort. And it’s only a matter of time before we enter the race and see how far we’re able to make it.

“A conventional bank with its conventional mindset, its physical presence related to cost structure, its culture of necessary bureaucracy, its knack for financing large-size projects, etc — can never turn into a digital bank.” - Mashrur Arefin, MD, The City Bank Ltd.

To learn more about investments and find out the easier ways to invest your funds, contact us at [enter @ wisergates dot com]

References:

Wright, G. (2024, January 24). World’s Best Digital Banks 2023—Round 2. Global Finance Magazine. Retrieved from https://gfmag.com/banking/worlds-best-digital-banks-2023-round-2-global-regional-winners/

The Evolution of Digital Banking. (2022). BPC Banking Technologies. Retrieved from https://www.bpcbt.com/blog/the-evolution-of-digital-banking

Bank accounts with budgeting tools. (2022). Bankrate. Retrieved from https://www.bankrate.com/banking/savings/bank-accounts-with-budgeting-tools/#wells-fargo

What is Digital Banking? (n.d.). Spendesk. Retrieved from https://www.spendesk.com/en-eu/what-is-digital-banking/

AI-Powered Personalization in Banking. (2021, April 27). Netguru. Retrieved from https://www.netguru.com/blog/ai-powered-personalization-in-banking

Digital banking trends and statistics. (2022, June 9). Bankrate. Retrieved from https://www.bankrate.com/banking/digital-banking-trends-and-statistics/#traditional-vs-digital

Digital Bank, a Gateway to Reaching Millions of Lives. (2022, January 23). EBL. Retrieved from https://www.ebl.com.bd/news/digital-bank-a-gateway-to-reaching-millions-of-lives