Bancassurance

Transcending Beyond Banking with the New Frontiers of Bancassurance

In the dynamic world of finance, traditional boundaries between banking and insurance are rapidly fading away, giving rise to a new phenomenon known as bancassurance. This innovative approach combines banking and insurance products in one place, offering customers a complete range of financial solutions. Bancassurance has quickly become a global phenomenon, and Bangladesh has recently embraced this opportunity, marking the inception of a new era in our financial landscape. As we lay the foundation for this new segment, let’s explore the global landscape of Bancassurance.

The Genesis of Bancassurance

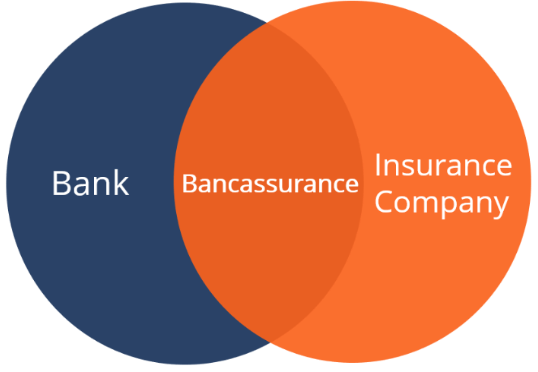

Bancassurance is a collaboration between a bank and an insurance company, where the bank sells insurance products through its established distribution channels. This partnership allows insurance companies to directly engage with the extensive customer base of banks, either through the banks themselves or their employees, to promote and sell their products.

While bancassurance is a relatively new concept in Bangladesh, its origins trace back to the late 1970s in Europe. The introduction of bancassurance in France aimed to enhance the influence of banks, responding to the desires of economists at that time. Over the past five decades, this business model has led to remarkable success in Austria, France, Germany, Italy, Portugal, Spain, and the UK. Collectively, these countries hold a significant 40 to 50 percent share of the global bancassurance market.

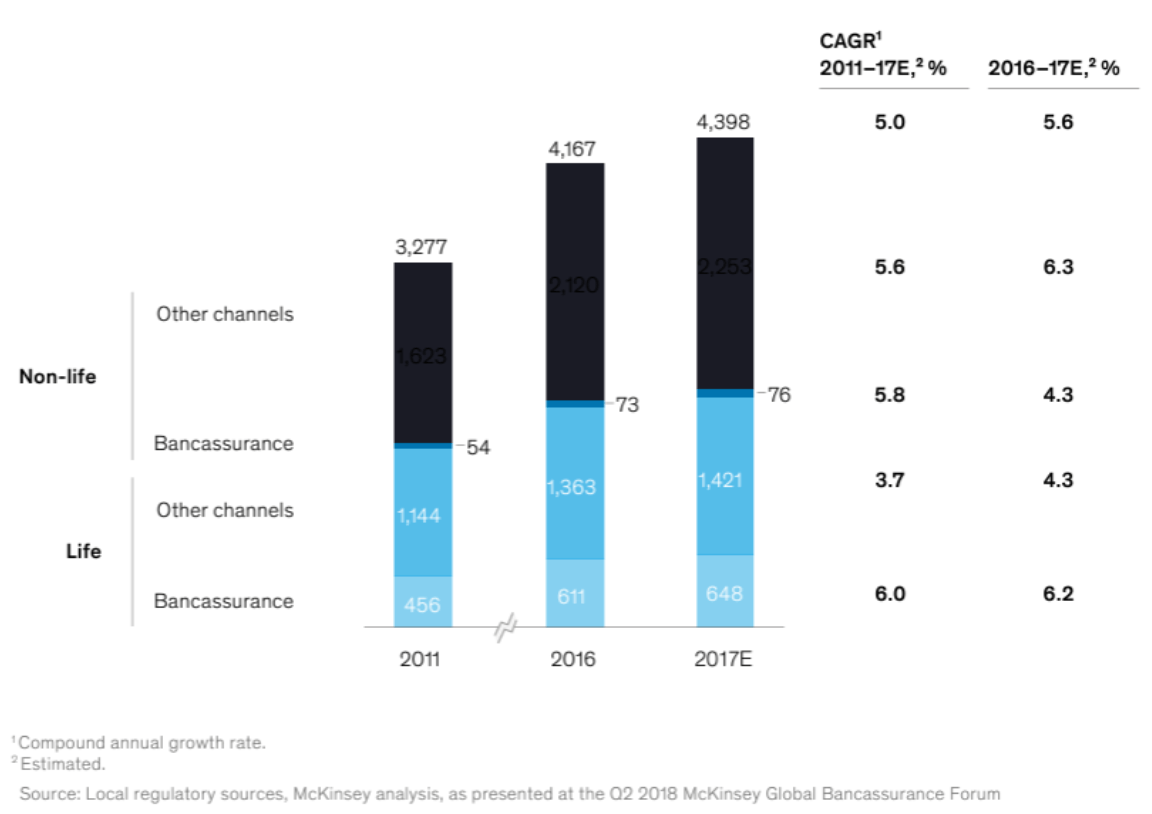

In recent years, bancassurance has been gaining popularity in East Asia and South America, marking an expanding trend in these regions. As of 2023, research conducted by IMARC Group reveals that the global bancassurance market has reached an impressive size of US$ 1,428 Billion. Projections for the future indicate substantial growth, with the market anticipated to reach US$ 2,255 Billion by 2032. This trajectory signifies a notable compound annual growth rate (CAGR) of 5.5% expected during the period from 2024 to 2032.

Navigating the Bangladeshi Market

Bangladesh, situated in the Asia-Pacific region, is poised for significant growth in the upcoming decade. Professor Hasina Sheykh, Chairman of Dhaka University’s Banking and Insurance Department, highlights that in India, insurance penetration increased by nearly 21 percent solely through bancassurance, while in Turkey, this rate surged by an impressive 79 percent. These compelling figures underscore the substantial opportunity awaiting Bangladesh in this domain.

Central bank data reveals a total of 11,239 bank branches across the country, including 5,287 branches in villages. Bangladesh is home to 81 operational insurance companies, comprising 35 life insurance companies and 46 non-life insurance companies. Despite this considerable presence, the insurance industry presently contributes only 0.5% to the GDP. However, the government aims to elevate this contribution to 4%, signaling a concerted effort to bolster the sector’s impact on the country’s economic landscape.

After a decade of negotiations, a collaborative effort between regulators, the government, and the industry has successfully formulated the framework for bancassurance, officially solidified in the middle of 2023. Both the Bangladesh Bank and the Insurance Development and Regulatory Authority (IDRA) have subsequently released comprehensive guidelines for bancassurance, marking its anticipated commencement on March 1, aligning with National Insurance Day.

Key elements of the regulations include the requirement for a bank to possess a minimum regulatory capital of 12.5 percent, meet a credit rating not below Bangladesh Bank’s rating grade-2, achieve a minimum CAMELS rating of 2 from Bangladesh Bank, maintain non-performing loans (NPLs) below five percent, and demonstrate positive net profits for the last three consecutive years. Additionally, a bank is permitted to enter into contracts with a maximum of three life insurance and three non-life insurance companies. However, there has been an exclusion of three major non-life insurance businesses—marine hull, marine cargo, and fire insurance, constituting over 80% of non-life insurance premiums—from bancassurance. This decision stems from the Bangladesh Insurance Association’s (BIA) assertion that these sectors are not yet ready for inclusion.

Recent developments

In a significant stride, leading banks in Bangladesh have secured approvals from Bangladesh Bank and entered into strategic partnerships with renowned insurance companies. Eastern Bank has recently become the first bank in Bangladesh to receive a bancassurance license for both life and non-life insurance companies. Following the approval from Bangladesh Bank in January of this year, Eastern Bank PLC (EBL) obtained the bancassurance license from the Insurance Development & Regulatory Authority (IDRA) to initiate a bancassurance business with MetLife and Green Delta Insurance Company Ltd.

Additionally, City Bank, MTBL, and Dutch Bangla Bank have formed partnerships with Guardian Life Insurance. BRAC Bank has also aligned with MetLife, and upon the formal opening of the Bancassurance channel, a diverse range of MetLife’s products will be accessible through BRAC Bank’s extensive network, including branches, sub-branches, and SME units.

The Potential and Prospects

With less than 1% of the world’s 168 million people currently insured, bancassurance targets a substantial untapped market. The market’s growth is propelled by factors such as rising customer demand for integrated financial services, a growing appetite for convenience and efficiency in financial management, and the emerging trend of customization observed across various industries. These dynamics collectively contribute to the evolving landscape and expanding significance of bancassurance.

Moreover, Banks have become influential players in the insurance market, playing a vital role in addressing gaps in geographical coverage, service provision, trust, and reliability, particularly in developing economies. Banks, armed with comprehensive client data, are well-equipped for cross-selling, thereby boosting the sales of tailored insurance products. The loyalty customers exhibit towards their banks contributes to a higher retention rate, as individuals often choose to purchase policies based on the financial guidance provided by their trusted banking institutions. Moreover, in a country with a relatively low level of insurance literacy like Bangladesh, bancassurance presents a crucial avenue for fostering greater financial awareness.

Such collaborations provide insurance companies with immediate access to millions of potential customers, enabling banks to augment revenue through the sale of insurance products. Simultaneously, it allows banks to mitigate credit risk exposures in various sectors such as Mortgage, Personal, SME, and Credit cards, while also enhancing the appeal of their existing product line. This symbiotic relationship establishes a win-win scenario, strengthening the financial landscape for both banks and insurance companies.

Challenges on the Horizon

While bancassurance presents a promising financial concept, there is a risk of mis-selling due to its novelty, posing challenges for both customers and financial professionals. It’s crucial to address the potential lack of familiarity among customers, bankers, and insurers, emphasizing the need for comprehensive knowledge on all fronts. To mitigate these risks, strict adherence to proper prudential regulations and accountability in the sale of such innovative products is imperative to prevent potential setbacks.

Moreover, Bancassurance is expected to exert considerable pressure on existing insurance agents. The insurance sector in Bangladesh, facing confidence issues due to low claim settlement ratios, confronts challenges such as fund embezzlement, poor investment quality, and liquidity crises. The competition between banks and individual agents hinges on the ability to persuade policyholders effectively. Should banks invest in training their officers involved in bancassurance, the potential benefits of this financial approach may be realized. A fair competition between corporate agents (banks) and individual agents is anticipated to enhance services for policyholders, fostering transparency and accountability in the process.

The journey towards a robust and inclusive financial ecosystem in Bangladesh has only just begun, and Bancassurance is undeniably at its forefront. As Bancassurance unfolds its potential in Bangladesh, it not only promises to redefine the financial landscape but also emerges as a key player in fostering financial education and protection. It stands out as a potent catalyst in the modern financial landscape, reshaping our perspectives and interactions with banking services.

To keep up with the latest trends in the financial world, check out our other articles and get in touch for personalized finance coaching.

References:

IMARC Group. (n.d.). Bancassurance market: Global industry trends, share, size, growth, opportunity and forecast 2022-2027. https://www.imarcgroup.com/bancassurance-market Rahman, S. (2022). Bancassurance in Bangladesh: Beginning of a new era. Mahbub Law. https://mahbub-law.com/bancassurance-in-bangladesh-beginning-of-a-new-era/ Allied Market Research. (n.d.). Bancassurance market. https://www.alliedmarketresearch.com/bancassurance-market EBL is first to get bancassurance license from IDRA for both life and non-life insurance companies. (2022). EBL. https://www.ebl.com.bd/news/ebl-is-first-to-get-bancassurance-license-from-idra-for-both-life-and-non-life-insurance-companies